The Irish Government’s presentation of Budget 2016 last October proved speculation and pre-Budget leaks to be correct. Soon after, the Government published Finance Bill 2015, part of the process that gives legal effect to the range of tax measures announced on Budget Day. The Finance Bill should be enacted in early December.

Budget 2016 was dubbed an “Election Budget” because the current Government’s term of office will come to an end soon, with elections timed for early 2016. True to form, every worker and pensioner will be financially better off as a result of the myriad of changes proposed to take effect on 1 January 2016 as a result of a €750 million Budget package of revenue-relieving measures.

Currently, Irish employees contribute to the Government by paying income tax in three ways:

- In the form of PAYE (Pay As You Earn)

- Social insurance in the form of PRSI (Pay Related Social Insurance), and

- USC (Universal Social Charge) on their incomes.

Combined, these result in an applicable marginal rate of tax of 52%.

However, based on the proposed reductions announced in Budget 2016, the marginal rate will be reduced to 49.5% for those who earn up to €70,044 per year, which is warmly welcomed by all concerned. This will be the first time since 2009 that the marginal rate has dropped below 50% for middle-income earners. About 1.97 million people are employed in Ireland, and this figure is forecast to increase to more than 2 million in 2016. The changes introduced in Budget 2016 are wide-ranging, have a major impact on payroll, and affect every employer and employee.

PAYE Changes

PAYE Changes

In 2015, a single employee entered the PAYE system once he or she earned more than €16,500 per year. Earnings between €16,500 and €33,800 are taxable at 20%, with the balance taxed at 40%.

The standard and higher rates of income tax remain at 20% and 40%, respectively. In addition, there has been no change to the SRCOP (Standard Rate Cut Off Point), which is the amount of a person’s income that is subject to tax at the 20% rate. Any income in excess of the SRCOP is chargeable at the 40% rate.

All taxpayers are entitled to claim Personal Tax Credits, which are used to reduce their income tax liability and are based on the individual’s marital, civil partnership, or parental status together with other qualifying criteria. While the majority of Personal Tax Credits remain the same, the following changes took effect on 1 January 2016:

1. Earned Income Tax Credit

A new tax credit has been introduced for self-employed people and proprietary directors to help bridge the gap between self-employed and PAYE taxpayers. The Earned Income Tax Credit (EITC) will be available to people with earned income who do not qualify for the PAYE tax credit of €1,650 (e.g., proprietary directors), and also will apply to the trading or professional income of self-employed people. The tax credit is calculated as 20% of the individual’s earned income, subject to a maximum amount of €550. Where an individual qualifies for both the EITC and the PAYE tax credit, the combined amount of these tax credits cannot exceed €1,650. The current Government intends to increase this tax credit in 2017 and 2018 if it returns to power.

2. Home Carer Tax Credit

The Home Carer Tax Credit is available to a married couple who are jointly assessed for income tax purposes where one spouse stays at home to take care of a dependent person. A home carer can claim only one tax credit regardless of the number of persons being cared for. If the carer’s income exceeds the income threshold in a tax year, this tax credit is restricted by 50% of the amount by which the income exceeds the threshold.

The Home Carer Tax Credit will increase by €190 to €1,000. The income threshold also will increase from €5,080 to €7,200. If the carer’s income exceeds €7,200, the tax credit is reduced by 50% of the excess income. If the carer’s income exceeds €9,200, the tax credit will be lost.

The Home Carer Tax Credit will increase by €190 to €1,000. The income threshold also will increase from €5,080 to €7,200. If the carer’s income exceeds €7,200, the tax credit is reduced by 50% of the excess income. If the carer’s income exceeds €9,200, the tax credit will be lost.

3. Tax Free Voucher

The Bill provides for a new statutory tax exemption on a voucher, up to a value of €500, that an employer can give to his/her employees. This will replace the current Small Benefit Exemption, which the Irish Revenue operated on a concessionary basis.

PRSI Changes

Currently, all employees are exempt from PRSI on earnings up to €352 per week (€1,525 per month). Where an employee earns above this exemption threshold, his or her total earnings are subject to PRSI at 4%.

A tapered PRSI credit was introduced on 1 January 2016 to offset the potential impact of the increase in the National Minimum Wage to €9.15 gross per working hour on lower-paid workers. The credit will be a maximum of €12 per week (€52 per month) and will be available, on a reducing basis, to employees who have a gross weekly income of between €352.01 and €424. From a PRSI perspective, an employee earning €360 per week will be better off by €10.67 per week in 2016 compared to 2015, while an employee earning €420 per week will only be better off by less than €1 per week. Those earning in excess of €424 per week are not entitled to the PRSI credit and will see no change to their PRSI liability.

Employers are also hit with a charge of Employers PRSI at 8.5% when they pay an employee up to €356 per week (€1,543 per month), which increases to 10.75% for employees earning in excess of this figure. The threshold for charging the higher rate of employer PRSI will increase to €376 per week (€1,629 per month). The lower rate of employer PRSI of 8.5% will apply to weekly earnings from €38 to €376 inclusive. In 2015, the annual cost to an employer of employing a person earning €18,720 per year is €20,732.40. However, this will reduce to €20,311.20 in 2016, resulting in a savings of €421.20 for an employer.

USC Changes

USC Changes

Employees are currently exempt from USC on annual earnings up to €12,012. However, once an employee earns in excess of €12,012, USC applies at the 1.5%, 3.5%, 7%, and 8% rates.

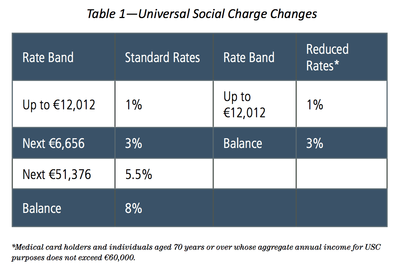

In 2016, the exemption threshold for paying USC increases from €12,012 to €13,000, removing approximately 42,500 workers from the charge completely. As a result of the proposed changes, it is estimated that more than 700,000 taxpayers will be exempt from USC in 2016. Where an individual’s income for USC purposes exceeds €13,000, USC will apply at the following rates and bands:

In addition to the increase in the USC rate bands as outlined in the table above, the 1.5% and 3.5% rates of USC have been decreased by 0.5% to 1% and 3% respectively. The 7% rate of USC has also been decreased by 1.5% to 5.5% (see Table 1 above). The 8% rate of USC remains unchanged, but the current Government promises to abolish the USC completely, on a phased basis, by 2020 if it remains in power.

Due to the decrease in USC rates and the increase in the USC rate bands, an employee earning €25,000 per year will be better off by €226.54 per year, while an employee earning €80,000 per year will be better off by €902.20 per year. Is this a case of the rich getting richer?

All measures in Budget 2016 are designed to grow the economy, create additional jobs, and increase living standards. Based on the examples included here, employees can certainly look forward to having more money in their pockets in 2016!