Brazil is the seventh largest economy in the world. It has one of the most complex payroll systems because of its constantly changing laws and the impact of labor unions with employment and compensation requirements. Brazil is known for high employee and employer taxes.

General Payroll Information

It is legally acceptable to provide employees electronic payslips. Payroll records must be kept for at least five years.

Company registration is required to process payroll. It can take between three to six months for a company to get established in Brazil, depending on how the company is structured. All companies are required to register with tax and social security offices to obtain a federal tax ID number, Cadastro Nacional da Pessoa Juridica (CPNJ).

Salary is calculated monthly, and advances paid usually between the 15th and 20th of the month. The advance payment has no taxes withheld.

Termination pay should be paid no later than 10 days after the date of termination.

Working Contracts

There are three different types of employees in Brazil:

- Employee

- Contractor

- Employee of Record

Your organization’s legal and finance teams will decide which employment structure will work for your organization based on your business services and products. Contractors have a defined requirement, and it is important to review and ensure you are compliant to avoid future employment legal issues or audits.

Employment Contracts—Employment contracts can be oral or written, but it’s a recommended practice to have a written contract in Portuguese. It is important to understand that Brazil’s employment laws favor employees, and it is common for employers to face litigation from former employees. Because of this, it is extremely important to have a detailed contract that is reviewed by an employment attorney.

Probation Period—The maximum probationary period allowed for an employee is 90 days or two 45-day terms. If the probation period of two 45-day terms is used, the employee can pass probation after the first term or be renewed for another 45 days. Employers can terminate employment at the end of the probation period and must pay final pay, which includes untaken vacation pay and a prorated 13th salary. The probation period details should be documented in the employment contract.

Working Hours—A typical workday in Brazil is eight hours per day, with a typical workweek not exceeding 44 hours per week. If the standard working hours exceed six hours, employees are entitled to a minimum of a one-hour lunch and rest period. The lunch period can range from one hour to one and a half hours.

Minimum Wage—The minimum wage was updated on 1 January 2022 to 1,212 BRL per month.

13th Salary—A 13th salary is required in Brazil and is equal to one month’s salary paid out in two parts in November and December. It is important to note at termination a pro-rated 13th salary is also due.

Overtime Pay—All working hours exceeding 44 hours a week are paid as overtime, which is regulated by the employment contract and collective bargaining agreements. The general overtime maximum is two hours per day and is paid at 150% of standard salary. If the employee works on a holiday, they are paid at 200% of the salary rate.

Tax Information

Personal Income Tax—All Brazilians and foreign residents are subject to personal income tax known as imposto de renda das pessoas fisicas (IRPF). The Ministry of Finance—Receita Federal do Brasil (RFB)—is a specific department responsible for collection of IRPF. All taxpayers must complete an annual tax return by 30 April. Employers must remit withheld taxes by the 20th day of the following month.

Personal Income Tax—All Brazilians and foreign residents are subject to personal income tax known as imposto de renda das pessoas fisicas (IRPF). The Ministry of Finance—Receita Federal do Brasil (RFB)—is a specific department responsible for collection of IRPF. All taxpayers must complete an annual tax return by 30 April. Employers must remit withheld taxes by the 20th day of the following month.

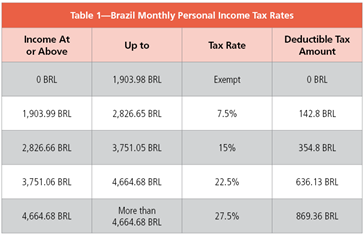

The monthly personal income tax rates for residents are listed in Table 1. The rates have not changed since 2015. Brazil residents are taxed on worldwide income. Nonresident earned income is taxed at 25% with no deductions.

Insurance Information

There are several types of social insurance programs (or schemes) that employees and employers must contribute to, including the following:

Social Insurance Programs—The social welfare, known as Parevidencia Social, covers payments for issues related to the following:

- Illness

- Disability

- Maternity

- Unemployment

- Retirement pension benefit

- Death

An employee’s contribution to the social security scheme is between 8%-11% of their monthly salary. The employer’s contribution is 12%. Pension retirement benefits are paid for men at age 65 and women at age 60. The pension benefit amount is 70% of the employee’s average monthly salary and increases 1% up to a maximum of 100%.

Employees are entitled to sickness or disability benefits after 12 months of contribution into the social security scheme. The payment benefit is based on short- or long-term incapacity and could range between 50%-91%.

Guaranteed Fund for Length of Service—All employers are required to enroll in and contribute to a Guaranteed Fund for Length of Service (FGTS) for each employee hired. The fund consists of an employee account located in the federal savings bank, which is owned by the employee. Withdrawals from the account are restricted to termination without justifiable cause, purchase of a house by the employee, and other specified situations.

Employers must contribute an equivalent of 8% of employees’ salaries to FGTS accounts. FGTS payments are calculated based on all amounts paid to employees, including overtime, hazardous pay, night work, 13th month bonus, vacation pay, and other payments.

Types of Leave

There are several types of leave available to employees in Brazil. These include the following:

Annual Leave—Paid annual leave or vacation is a minimum of 30 holidays per year following one year of service. The leave is typically taken in two periods of 20 and 10 days.

Sick Leave—The employer must pay the employee’s salary for the first 15 days of sick leave, then the Brazilian social security agency (INSS) will be responsible for the payment.

Maternity Leave—Female employees who take maternity leave receive 120 days of leave for the birth or adoption of a child. The maternity benefit is paid by the INSS. The employer can extend the leave to 180 days if the employer enrolls in the government scheme Empresea Cidada.

Paternity Leave—Fathers are entitled to five days of paid leave, but the employer can extend to 20 days if the employer enrolls in the same government scheme Empresea Cidada to extend maternity leave.

Bereavement Leave—Five days of paid leave for a family member.

Marriage Leave—Employees are entitled to three consecutive days of paid leave.

Family Leave—Employers are entitled to 30 days of paid leave per year to provide care for family members younger than age 12, which is reduced to 15 days for older family members.

National Holidays—There are several national holidays* employers follow in Brazil. These are listed in Table 2.

Brazilian Culture

The Brazilian culture is dominated by Portuguese influences. Local traditions are centered around capoeira, sports, Carnival, and religious holidays. In Portuguese, Olá means “hello” and Obrigado means “thank you.”

Read Mary Holland’s feature, "How to Succeed With a Global Payroll Implementation Project", in this month’s Global Payroll.

Do you like our content? Join the GPMI community to get free education and articles straight to your inbox!

Mary Holland, CPP, is Chief Customer Officer at Payslip.