When your business is setting up in a new country, employment contracts are one of the key questions to consider. This is especially important for U.S. businesses where employment contracts are neither mandatory nor as common as in other countries. However, they are critically important overseas—and your business expansion will likely be delayed if you do not plan in advance.

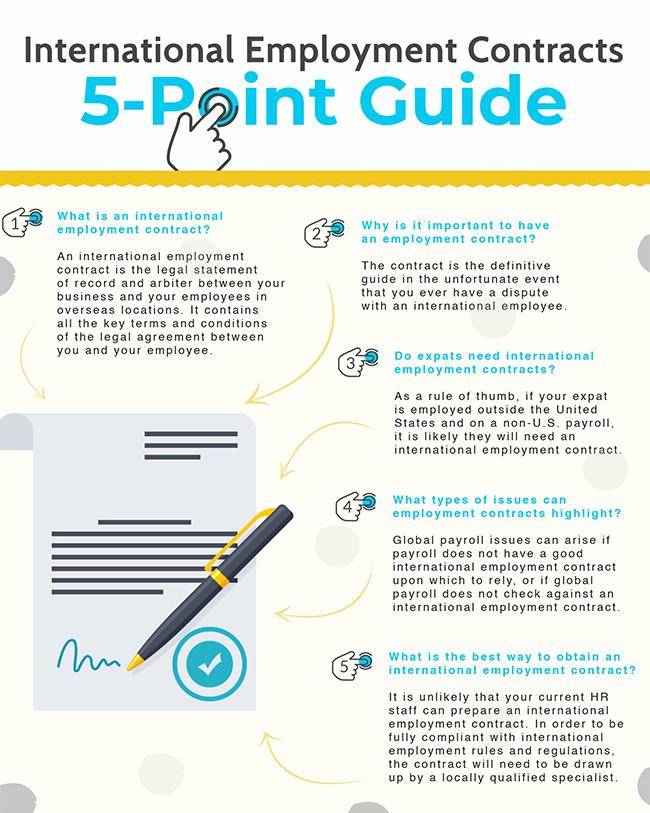

The following provides an introduction to some of the basic facts about international employment contracts, with a simple guide to many of the most common questions asked.

What Is an International Employment Contract?

An international employment contract is the legal statement of record and arbiter between your business and your employees in overseas locations. It contains all the key terms and conditions of the legal agreement between you and your employee. Items such as salary, benefits, vacation rights, sickness, termination, confidentiality requirements, notice period, and other important employment conditions are included.

It is not possible, unfortunately, to have a single contract that covers every one of your foreign employees. Each country has its own employment laws and jurisdiction, so a different contract is necessary for each. In certain countries, more than one contract is necessary. For example, in Canada it is advisable to have a contract for each province.

An international employment contract is subject to the laws and regulations of the specific country where your employee is working. As such, it needs to be fully compliant with that country’s employment laws and regulations. For example, an employee hired in Australia will require an Australian employment contract. In the event of a dispute, the labor dispute will typically be handled by local courts or tribunals in-country.

Why Is It Important to Have an Employment Contract?

There are several reasons why it is important to sign employment contracts with your employees in other countries. Employers in the United States should bear in mind that legal employee protection is typically much stronger internationally than it is domestically. As a result, an employment contract is often a compulsory requirement in the country where you are operating—your business may be breaking local laws if it is lacking.

The contract is the definitive guide in the unfortunate event that you ever have a dispute with an international employee. If a compliant local contract exists between your business and an employee, then any settlement with your employee is governed by the contractual terms. If you do not have an employment contract, your exposure is much more uncertain. When your employee dispute is resolved by local courts or by arbitration, the ruling body will refer to local employment laws and customs, and it may simply disregard your own business’ internal policies.

Do Expats Need International Employment Contracts?

The situations for expatriate employees must be addressed on a case-by-case basis. As a rule of thumb, if your expat is employed outside the United States and on a non-U.S. payroll, it is likely they will need an international employment contract.

If your expat remains on U.S. payroll and is employed by a U.S. entity, then the position can be more complicated and requires situational analysis. Remember that international employment contracts can also be obligatory for work permit reasons.

What Types of Issues Can Employment Contracts Highlight?

Global payroll issues can arise if payroll does not have a good international employment contract upon which to rely, or if global payroll does not check an international employment contract. The most common errors will include inaccuracy and omission. Here are a few of the issues that employment contracts can prevent:

- Incorrect Application of Collective Bargaining Agreements (CBAs)—In countries where they apply, such as France, CBAs are a critical component of payroll. They govern various aspects of employee terms and conditions including working hours, overtime payments, and vacations. They can be applied industry-wide within a country or be negotiated directly between a company and its employees. Employment agreements will inform payroll which CBA should apply to each employee, and they will highlight the correct treatment where a CBA applies.

- Inaccurate Salary Raises—In some countries there are statutory or even trade-related regulations governing salary increases for employees. A good local employment contract will refer to these obligations. This allows payroll to ensure that the annual salary raises for international employees are legally compliant.

- Accrued Leave—If your international employee moves on to a new organization, global payroll will want to ensure that it has accrued for all their outstanding leave obligations. This can be complex. Many countries have their own local employment rules for annual employee leave requirements, how long these can be carried forward, and even how much of these can be accrued.

What Is the Best Way to Obtain an International Employment Contract?

It is unlikely that your current HR staff can prepare an international employment contract. In order to be fully compliant with international employment rules and regulations, the contract will need to be drawn up by a locally qualified specialist.

The good news is that it is not as difficult or expensive as you may think to get an international employment contract. Unless your requirements are highly unique, you can use a local employment law specialist who is experienced in drawing up in-country employment contracts for international companies. This will be fully compliant locally and much less expensive than a partner/director from a global law firm.

A good advisor will usually start with a template approach to cut costs and save time. This type of approach starts with a locally compliant employment contract and allows you to change only the items specific to your requirements. Remember that local employment rules and regulations are continually changing. Some of these changes may one day affect you by overriding the terms and conditions of your employment contract.

It is worth retaining a relationship with your international HR advisor so that they can proactively update you on any changes that impact your business.

John Galvin is Founder and CEO of the award-winning international expansion company Galvin International. He is a former multinational CFO (Dow Jones, Thomson Reuters) with more than 20 years of international commercial and finance experience. He has directly led successful global payroll, accounting, and tax implementations. Galvin advises multi-national companies on global payroll and helps clients expand all over the world by providing a one-stop service for compliance and commercial services in more than 100 countries.

John Galvin is Founder and CEO of the award-winning international expansion company Galvin International. He is a former multinational CFO (Dow Jones, Thomson Reuters) with more than 20 years of international commercial and finance experience. He has directly led successful global payroll, accounting, and tax implementations. Galvin advises multi-national companies on global payroll and helps clients expand all over the world by providing a one-stop service for compliance and commercial services in more than 100 countries.