New Zealand is an island country located to the southeast of Australia in the Pacific Ocean and is separated from Australia by the Tasman Sea, with about 1,600 kilometers of distance between the two countries at their closest points to each other’s mainland. The country comprises two main islands—the North and South islands—and several small islands, some of them hundreds of miles from the main group. The government of New Zealand is a constitutional monarchy with an elected parliament.

New Zealand is an island country located to the southeast of Australia in the Pacific Ocean and is separated from Australia by the Tasman Sea, with about 1,600 kilometers of distance between the two countries at their closest points to each other’s mainland. The country comprises two main islands—the North and South islands—and several small islands, some of them hundreds of miles from the main group. The government of New Zealand is a constitutional monarchy with an elected parliament.

Mention New Zealand to most people, and they may instantly picture a scene from “The Lord of the Rings” or “The Hobbit.” The franchise has been the best unpaid advertisement for the country, helping to improve its economic standing within the last decade. The country is dominated by the free market, and its major industries are tourism, manufacturing, and agriculture. It has a GDP of $196 billion and only 4.8 million citizens. When it comes to payroll regulations, there are several considerations that make New Zealand different from other countries. Payroll consists of the general deductions for taxes, but there are also extenuating circumstances for things like student loans and KiwiSaver deductions. If you do not make all your payments, you risk hefty fines for late payments.

Taxes

Employers in New Zealand are responsible for withholding income taxes, social taxes, and fringe benefit taxes from employee pay and benefits. Employers must also make employer-mandated social tax contributions and pay the Employer Superannuation Contribution Tax (ESCT). In addition, employers must uphold New Zealand compensation and benefits laws.

Income Taxes

All employers that employ at least one employee generally must register as an employer, withhold income taxes from employees, and remit income taxes withheld under New Zealand’s Pay As You Earn (PAYE) system, administered by the Inland Revenue Department (IRD).

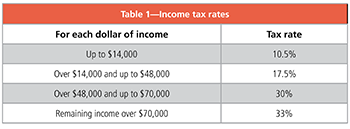

Income tax rates are levied on a progressive scale, with rates ranging from 10.5% to 33%. In New Zealand’s progressive income tax system, portions of an individual’s income are allocated to New Zealand’s personal income tax brackets, and each portion of income allocated to a tax bracket is taxed at the tax rate applicable to that tax bracket.

Income tax rates are levied on a progressive scale, with rates ranging from 10.5% to 33%. In New Zealand’s progressive income tax system, portions of an individual’s income are allocated to New Zealand’s personal income tax brackets, and each portion of income allocated to a tax bracket is taxed at the tax rate applicable to that tax bracket.

Effective from 1 April 2020, New Zealand’s personal income tax rates for residents and minimum and maximum amounts of annual income for each tax bracket are as indicated in Table 1.

Social Taxes

All employees generally are covered by the Accident Compensation Corporation (ACC). Coverage includes an employer work account levy (abbreviated as EMP) and a working safer levy (abbreviated as WS), both of which are assessed on employers, and an earners’ levy, which is assessed on employees. The EMP, also simply known as the work levy, is remitted to the work account to fund replacement income for individuals who experienced work-related injuries and accidents. The WS supports WorkSafe’s activities and injury prevention across the country. The earners’ levy is charged to cover the cost of rehabilitation and compensation following non-work-related injuries.

KiwiSaver Contributions

All employers must withhold and contribute to the KiwiSaver retirement system for employees who are covered by KiwiSaver. The system is overseen by the IRD.

Employees who are at least age 18 generally are automatically enrolled in KiwiSaver if they are eligible for the program based on their degree of presence in New Zealand, although they may choose to opt out of the program. Employees are eligible for KiwiSaver based on their presence in New Zealand if they live in the country, normally live in the country, are a citizen of New Zealand, or are not a citizen but are otherwise entitled to indefinitely reside in New Zealand.

Employers must withhold KiwiSaver contributions from employment income paid to employees covered by KiwiSaver. The KiwiSaver contribution withholding rate applicable to an employee’s gross salary generally is the rate the employee indicated on the employee’s Form KS2, KiwiSaver Deduction Form. Employees are required to choose a KiwiSaver contribution rate of 3%, 4%, 6%, 8%, or 10% of their gross salary. The options to select a KiwiSaver contribution rate of 6% or 10% have been available since 1 April 2019. When employees fail to choose a contribution rate, employers must make deductions at the default rate of 3%.

ESCT

Employers must withhold ESCT from the contributions that they pay into an employee’s retirement account. Employer superannuation contributions cover any cash contribution to a superannuation fund that was paid by the employer for the employee’s benefit, including KiwiSaver contributions and contributions to employee retirement funds outside the KiwiSaver program.

Fringe Benefit Tax

The Fringe Benefit Tax (FBT), which is payable by employers, is a tax on benefits that employees receive because of their employment, including those benefits provided through someone other than an employer. Benefits include the provision of a motor vehicle for use by employees, provision of a loan as a result of an employee’s employment, provision of goods and services, subsidized transport, contribution to funds, insurance, annuation funds, and other benefits.

Working Hours, Conditions, Overtime Pay

There are no official working hour rules in New Zealand, but business hours are generally 8:30 a.m. to 5:00 p.m. with a 40-hour limit per week. Lunch is normally a half-hour long. All employees must have written contracts that stipulate the terms of their employment. These contracts spell out practically everything about the employee/employer relationship. Very few industries are subject to collective bargaining in New Zealand, so workers negotiate on behalf of themselves based on their skill level. Overtime pay is not required in New Zealand but is typically given to employees. The exact wages (e.g., time and a half, double time) are worked out in the contract.

Trial periods are about 90 days and are typically instituted by most employers directly after hiring. Longer probationary periods are allowed in New Zealand but must be negotiated by both employee and employer. Employees must be paid during this time, and their rights cannot be violated. There are no set time limits, but the length of probation should be reasonable to the job and circumstances.

Compensation, Termination, Severance, Bonuses

Effective 1 April 2020, the standard minimum wage is NZ$18.90 per hour. There are no set rules when it comes to raises, though in the past the numbers have been historically low (e.g., 1% to 2% a year). Companies have recently started to rethink their compensation packages for their most valuable employees. New Zealand does not have official termination policies. While there is no mandatory notice period, employers and employees generally provide required notice periods in their employment agreement. Employers must pay employees for any unused leave provisions accrued after an employment relationship is terminated. If an employee receives severance pay, it is due to the terms being written in the employee contract. All wages and future raises or bonuses are typically negotiated before an employee’s first day on the job.

Vacation, Sick, Bereavement, Parental, Workplace Injury Leave

Vacation leave

Full-time employees are entitled to four weeks of paid annual leave each year. The leave is granted on their first and subsequent anniversaries after starting work.

Sick leave

Employers must grant all employees five days of paid sick leave after their first six months of continuous employment, and must grant an additional five days of paid sick leave after every subsequent 12-month period of employment.

Bereavement leave

After six months of employment, employers must grant all employees with three days of paid bereavement leave in the case of the death of an employee’s spouse or partner, parent, child, sibling, grandparent, or grandchild. For other deaths, up to one day of paid leave may be taken if the employer accepts that the employee is bereaved.

Paid parental leave

Effective since 1 July 2018, employers must grant female employees who gave birth to a child and employees of either gender who are adopting a child with 22 weeks of paid parental leave. Effective since 1 July 2020, employees are entitled to a parental leave period of 26 weeks for births or adoptions. The paid parental leave provision is paid for by the IRD to one parent at a time and may be transferred between parents.

Workplace injury leave

Employers must grant all employees injured while performing work-related duties with one week of paid leave, paying employees at least 80% of their normal wages during this period. After this one-week period, the Accident Compensation Company will provide the employees with paid leave.

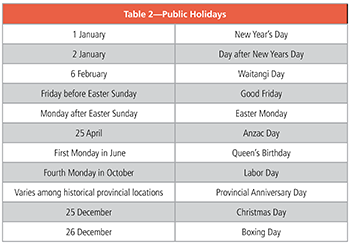

Holidays

The Holidays Act of 2003 specifies 11 mandatory paid public holidays. New Zealand’s paid public holidays are as indicated in Table 2.

Do you like our content? Join the GPMI community to get free education and articles straight to your inbox!

Nadia Camarena, CPP, is the Director, Global Payroll Operations for Netflix, Inc., and has 27 years of experience. Her current responsibilities include managing payroll in EMEA, LATAM, APAC, and North America. Her career encompasses many different industries like small business, automotive software, and the tech world. She is also a member of the American Payroll Association’s SPLTF Global Issues Subcommittee.