Technology is quickly making our world a smaller place, bringing people together and providing opportunities for shared experiences that were not possible before. It’s exciting, enlightening, and inspiring. There’s so much we are learning from each other, and we’re getting better at collaborating virtually every day.

Technology is quickly making our world a smaller place, bringing people together and providing opportunities for shared experiences that were not possible before. It’s exciting, enlightening, and inspiring. There’s so much we are learning from each other, and we’re getting better at collaborating virtually every day.

Global business is taking off, and there are few boundaries that stand in the way of progress, connectivity, and growth. But in this rapidly moving modern world, this surge in automation, information, and globalization is also generating the need for new scrutiny and regulations to govern how organizations manage digital processes. Rules and mandates are being adopted–often resulting in complexities for the business world, especially when it comes to core business functions such as global invoicing.

Why Is Global Invoice Compliance So Complex?

With an array of tax laws, dozens of varying requirements around invoice receiving and archiving across various countries, multiple currencies, multiple languages, and differing invoice formats and standards, it’s easy to see how businesses are faced with major challenges and concerns over risk when it comes to global compliance. On top of that, the world of global compliance is constantly changing.

If you have been keeping up with the news, you have heard that Italy recently mandated business-to-business (B2B) electronic invoicing. Italy is one of the pioneers in e-invoicing. Long before the deadline was set by the European Union (EU) directive, Italy made electronic invoicing mandatory for invoices submitted to government organizations. And since January 1, 2017, even private companies in Italy have had the option to submit invoices electronically.

However, until now, this system was voluntary, and adoption remained low despite the tax incentives offered. Now, the Italian government has decided to make electronic invoicing also mandatory in the private sector. This means a huge change in how you do business if your organization has operations in Italy.

Then there is Singapore, which recently opted to embrace the PEPPOL (Pan-European Public Procurement On-Line) e-invoicing standard. The initiative was co-funded by the European Commission to enable European-wide exchange of electronic invoices and business documents amongst private and public businesses of any size to foster European-wide commerce opportunities. Singapore is the first Asian country to join the program, which is currently used by 19 European countries including Britain, Germany, and Norway.

Latin America has mandated that invoices be sent in an electronic format through federal tax authorities’ electronic systems to help reduce fraud.

And we’ve only touched on a handful of countries–a small part of the whole compliance universe. Global enterprises have their work cut out for them just with ensuring they are invoicing their customers the right way.

Why Is Global Compliance So Critical?

As it relates to the accounts payable (AP) process, the invoice is not only a transaction document, it is also an important source of truth for governments when it comes to tax collection. Electronic invoices are recognized as equivalent to paper invoices for the collection of taxes such as value added taxes (VAT), goods and services taxes (GST), or sales and use taxes. For many countries, these taxes constitute a significant source of revenue. So, it’s not surprising that there is so much emphasis and regulation around the invoice management process in business-to-government (B2G) and now even B2B.

There are three primary areas in the AP process where companies are expected to understand the rules and comply:

- Invoice receipt—The invoice is the prime audit source for tax collection, so when it comes to invoice receipt, the form, the content, and the method used for creating and exchanging invoices are highly regulated.

- Invoice archiving—Archiving the invoice is also a critical component, as it is a base requirement almost everywhere. It is the common denominator for tax compliance across countries. Even though electronic invoicing rules vary from country to country (e.g., how long a company is required to archive and when it should dispose of old invoices), almost all of them mandate the archival of the “original” invoice.

- Capture of tax rate on the invoice—Companies must properly note and calculate the tax rate by country on the invoice.

At a high level, the obligations around invoice compliance exist so that a tax administration can:

- Verify the integrity and authenticity of invoices by guaranteeing that invoices are real and unchanged from the moment an invoice is issued until the end of the mandatory archiving period.

- Confirm that taxes have been correctly administered, reported, and paid by verifying the nature of the supply, the consideration (fee), and relevant business terms of the transaction. Therefore, the content of an invoice must meet certain minimum criteria.

- Interpret the invoices they audit, so legibility of invoices must be guaranteed.

- Prove the veracity of business transactions (often referred to as “supplies”) within the scope of tax law.

What Is the Risk of Noncompliance?

Since taxes are a significant source of revenue for many governments, the consequences of noncompliance can be very severe, ranging from administrative fines to sanctions under criminal law, including:

- Administrative fines if veracity of invoices cannot be proven

- Protracted audits that increase risk of more scrutiny

- Spillover effects into other areas of taxation or accounting

- Trading partner audits that negatively impact relationships with business partners

- Loss of right to deduct VAT and obligation to pay VAT over erroneous invoices

- Sanctions under criminal law in some countries where noncompliance is equated with tax evasion

What this means for you is that compliance can no longer be an afterthought. In the 1990s, and even up to 2014 or 2015, organizations would define an invoicing strategy, implement some form of automation, and then evaluate whether that strategy could also address compliance concerns. Today, that process has been flipped on its head. For any organization operating globally, compliance has become a minimum requirement of its global business strategy.

How Do Companies Ensure Global Compliance?

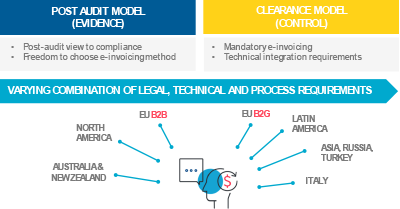

For multinational organizations, keeping up with the rules and regulations in geographies where they operate is a burden, whether they are exchanging invoices in paper format or electronically. Most compliance models can be classified into two broad categories (see Figure 1):

- Post-audit model—This model is mainly used by North American, European, and Commonwealth countries, and it mandates that electronic invoices are preserved and made available for audit after the invoice has been issued.

- Clearance models—This model is more common in Latin America and Asia-Pacific. It is more complex and mandates electronic invoicing. Further, all parties involved in a transaction need to comply with the rules, regulations, and technical specifications aimed at eliminating tax avoidance.

The world is constantly changing in terms of which model each country adopts and the complexity of regulations. However, there is one clear trend that has been emerging—an increasing shift away from post audit models to more real-time mandatory controls, or clearance systems. And even clearance systems that have been in place for some time now have not stopped evolving.

The world is constantly changing in terms of which model each country adopts and the complexity of regulations. However, there is one clear trend that has been emerging—an increasing shift away from post audit models to more real-time mandatory controls, or clearance systems. And even clearance systems that have been in place for some time now have not stopped evolving.

To further complicate matters, even when e-invoicing is required, there are variances in those requirements by country. Most countries in Europe follow a common basic approach with varying levels of local specific requirements. On the other hand, Latin America, South America, Russia, Asia, and Turkey follow a very locally fragmented approach with extremely specific and strict requirements.

Electronic invoicing in Africa is still relatively new, with very little specific regulation. And regulatory guidance and practical interpretations are not always clear. In practice, organizations need to understand all the different local and cross-border requirements, design an approach to meet those requirements, and ensure flexibility in their business environment to adapt as requirements change.

How Can Technology Help Ensure Global Compliance?

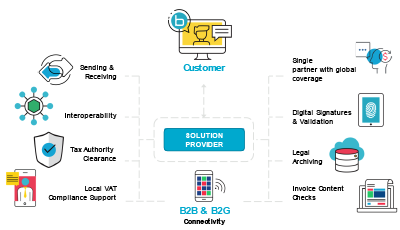

Multinational organizations often overcomplicate the process of global compliance by trying to manage the complexities of multiple local invoice regulations themselves. But what they really need is an invoice automation solution that will help them comply with local invoicing regulations automatically as part of the global automation solution (see Figure 2). Let’s reiterate here—automatic global compliance means the proper controls, checks, and assurances are happening as part of the established invoice automation process without human intervention or manual processes that eat up valuable time, generate frustration, and pose risk.

Multinational organizations often overcomplicate the process of global compliance by trying to manage the complexities of multiple local invoice regulations themselves. But what they really need is an invoice automation solution that will help them comply with local invoicing regulations automatically as part of the global automation solution (see Figure 2). Let’s reiterate here—automatic global compliance means the proper controls, checks, and assurances are happening as part of the established invoice automation process without human intervention or manual processes that eat up valuable time, generate frustration, and pose risk.

There are many benefits to automating your invoice process and ensuring compliance through technology:

- Increased efficiency to lower costs associated with handling global invoice compliance and to free up valuable resources so they can focus on the core business

- Reduced risk from having access to up-to-date tax information and avoiding financial penalties and other sanctions associated with noncompliance of regulations

- More control through comprehensive audit trails including original invoice images, secure data transfer, and additional compliance measures throughout the process

How to Choose an Invoice Automation Solution

Seek out a provider with global expertise, in addition to solution functionality. According to PayStream Advisors, global AP automation providers must offer more than multicurrency and multilanguage support. Providers must demonstrate a deep knowledge of various countries’ e-invoicing regulations and adjust quickly as largely unregulated regions (APAC for example) present new compliance challenges.

Ensure that the provider of choice has the necessary experience managing all the aspects of compliance from identifying obligations and assessing requirements to designing and managing solutions and keeping track of all the changes in the regulatory environment. Look for a solution provider that has a large, established global presence and the resources to keep up with the ever-changing compliance landscape.

Beyond having experience in the markets where they operate, ask these questions of providers before deciding upon a solution:

- Where are the provider’s clients (which countries and how many in each country)?

- What industries are the provider’s clients in?

- What market segments are the provider’s clients in?

- Has the provider built new, region-specific features or support for any clients?

- How long has the provider been operating in each of its supported countries/regions?

- Does the solution calculate VAT automatically?

- Does the solution include an electronic archiving tool?

- Is technical support available in local languages?

- Does the provider have multi-language teams in various countries?

At the end of the day, compliance is a complex process. The greatest value any solution provider can deliver is the number of countries that they are compliant in, including the ones with the most stringent requirements and the experience they have in these countries. With the right automation solution, you can get all the primary process benefits while also lowering compliance risk.

Why Trust the Experts?

Trying to manage global compliance internally quickly becomes cumbersome, time-consuming, and risky. PayStream Advisors strongly recommends that organizations access the services of global AP experts who understand the environments, circumstances, and requirements of each country before entering foreign markets. Ultimately, you want to simplify your operations so you get back to your exciting global expansion and do what you do best: running your business.

Do you like our content? Join the GPMI community to get free education and articles straight to your inbox!

Sushmitha Koka is Head of Product Marketing, North America at Basware. She brings more than 14 years of experience in the Procure-to-Pay (P2P) space from her prior roles at Oildex and ADP, where she was responsible for product management for their P2P business and PayStream Advisors, a niche research and consulting firm where she worked as both a market analyst and consultant. Her main areas of expertise include electronic invoicing and payments, document and data management, and electronic procurement. She has published a number of articles and has been quoted in trade publications. Koka has an MBA from the University of North Carolina, Kenan-Flagler Business School, Chapel Hill.