Businesses in the Asia-Pacific (APAC) region may have to break out their checkbooks if they don’t upgrade, consolidate, and integrate their payroll processes.

That’s one conclusion that can be drawn from the research ADP, a provider of payroll and compliance expertise, recently conducted to better understand how new payroll compliance laws are impacting the payroll practices and strategies of businesses in the APAC region. It’s a revealing study considering businesses across the APAC region have adapted to more than 560 changes to payroll legislation in the past three years—a breathtaking and daunting pace, to be sure.

The Asia-Pacific region is diverse. For example, ADP’s business in APAC includes domestic operations in Australia, China, India, Singapore, and the Philippines, yet serves clientele directly or through partners in more than 20 additional countries in the region, such as Bangladesh, Fiji, Guam, Indonesia, Japan, Korea, Malaysia, New Zealand, Pakistan, Sri Lanka, Taiwan, Thailand, and Vietnam.

Frequent updates to payroll legislation across APAC make payroll administration increasingly complex as organizations expand their businesses further into the region and across the globe. After surveying 240 APAC payroll professionals, ADP published the findings in a report titled Key Considerations in Payroll Management: The View from APAC. One insight: Despite the availability of advanced payroll solutions in the market, an average of 32% of companies across APAC still manage payroll by using paper or spreadsheet-based, in-house systems. This includes 73% of organizations in Indonesia and 57% in the Philippines.

Global payroll leaders can reduce costs, as well as act as catalysts to help drive long-term savings, efficiency, and scalability for their companies, by considering two fundamental approaches to payroll management:

- Consider working with an outside service provider—Many companies across the globe are discovering they need help managing their payroll services or want to work with an outside vendor to advance to the next level of technology and support. When selecting a payroll partner, organizations should look for a service provider that can help clarify their business needs, understand and analyze their existing, often disparate, payroll systems, and provide global expertise to support future business change. Advanced payroll software, when properly leveraged and managed with the right vendor, can provide a holistic, reliable global payroll solution while also helping to mitigate compliance risk and deliver an improved user experience for employees. In addition, these systems enable global payroll professionals to more easily access companywide HR data and analytics, industry benchmarks, and other key performance metrics to further benefit the business.

- Adopt integrated systems—Looking ahead, global payroll professionals should shift from task-management duties to value-based contributions. Beyond simply ensuring compliance with evolving tax and labor laws and paying workers accurately, global payroll professionals and their organizations should consider adopting integrated systems that offer analytical tools to help identify insights that will enhance decision-making among the leadership team.

Disparate Payroll Systems Can Create Compliance Challenges

By consolidating payroll systems, organizations in APAC are able to improve their compliance with local payroll regulations. The ADP study showed that payroll executives who rely on multiple payroll vendors are less confident that their solutions help them remain compliant with ever-changing local payroll legislation. In fact, 80% of payroll professionals who use a single payroll solution agreed that their solution helps their organization comply with payroll legislation, compared to 60% of professionals who used six or more vendors.

Generally, many multinational organizations are realizing the need to consolidate their global payroll as integrated payroll systems offer many advantages, including ease of compliance, operational efficiency, and consolidated reporting. But this research shows that 79% of organizations in the APAC region have fragmented payroll structures, and only 9% have one solution or vendor.

The remaining 12% of APAC organizations use one payroll solution and one vendor for global rollout of payroll. Employers based in the APAC region use, on average, more payroll vendors than non-APAC employers—five versus three vendors, respectively. The risks associated with a fragmented or siloed payroll management system increase 3.5 times if an organization is working with six or more vendors rather than a unified solution.

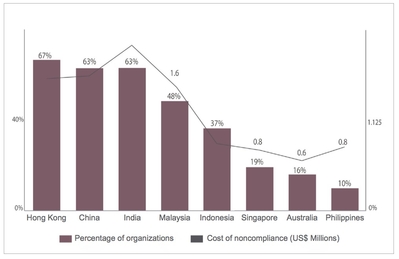

The research also indicated that with growth comes an increased risk of regulatory noncompliance. Keep in mind, there have been 562 changes to payroll legislation across the APAC region in the past three years. Navigating these changes with disparate HR and payroll management systems can lead to inaccurate calculations and deductions, late payments, and even penalties (See Figure 1). Within the past five years, approximately 40% of APAC organizations have faced noncompliance issues related to payroll, most notably organizations in Hong Kong, China, and India. During the same five-year period, the average cost incurred by APAC organizations due to payroll noncompliance was nearly $1.24 million (USD).

Despite a gradual adoption of integrated payroll management systems and noncompliance challenges across the region, China is one of the foremost proponents of moving its payroll systems and applications into the cloud and driving mobile platforms as the interface for modern HR systems. Cloud-based solutions enable companies to consume computer resources that are located off-site in a data center rather than having to build and maintain computing infrastructure in-house. Support for a cloud-based approach was apparent, for example, during the HR Technology Conference and Exposition in Zhuhai, China, in April 2016.

That conference revealed that China is a good example of APAC HR and payroll trends. As it transforms from a manufacturing and export economy to one more focused on consumers and services, leadership talent and skills have soared to the top of the checklist for HR departments in local enterprises. In fact, Chinese HR leaders are using their positions in their companies to lead business transformation through their pursuit of leadership talent. As they do this, they display three unique attributes:

- A desire to drive and adapt to change—Traditionally, HR organizations in China have managed workforce issues such as repeated rounds of hiring on a massive scale (potentially 1,000 employees at a time), retaining a workforce willing to change jobs for a bit more pay, and significant compensation increases yearly. They now have a desire to accommodate the rapid pace of change and view workforce issues through a broader human capital management (HCM) lens that encompasses talent management, skills development and learning, and employee engagement.

- A focus on global issues—While the Chinese economy is being driven by exports and other markets, Chinese companies are expanding regionally and globally. They’ve naturally and rapidly reached the juncture where HR has evolved into HCM. Global challenges for them are a daily occurrence and include compliance, talent management, geographic expansion, and technology that enable a global approach to business.

- A keen interest in creating a future-proof, global HCM strategy—Even the most experienced HR professionals from Chinese companies have been forced throughout their careers to “weight” certain aspects of HR above others. Areas such as talent acquisition, HR administration activities, and retention took precedence over other aspects of their roles. Since it hasn’t been a focal point of success in a high growth environment, Chinese HR leaders are noticing gaps as they try to create a comprehensive approach to HCM. As the country transforms with remarkable speed, they are incredibly eager to learn. This fervor is driven by technology advancements.

A Need for Integrated Payroll Management

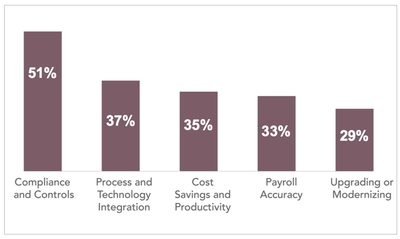

The APAC region also creates challenges for complying with different workforce regulations across myriad jurisdictions. A 2014 Global Payroll Operations study by Deloitte showed that compliance, controls, process, and technology integration were top priorities for payroll professionals (See Figure 2). The same Deloitte study found that one in two payroll professionals in APAC lacked confidence in his or her organization’s ability to protect itself from a security breach.

Overall, recent research shows a general dissatisfaction among APAC payroll professionals in many key areas of payroll management and security, including compliance, technology integration, cost savings and productivity, payroll accuracy, and the speed of upgrading/modernizing processes and systems.

One result of these frustrations? The largest APAC firms are starting to take action to reduce their exposure to operational risk. ADP’s study found that nearly all APAC multinational companies with 20,000 to 50,000 employees are outsourcing their payroll services, while just 40% of organizations with fewer than 100 employees and 56% of employers with 101 to 500 employees are doing so. For smaller companies, the perceived high cost and time savings may be deterrents to investing in or even exploring more advanced payroll solutions.

It’s time for many APAC businesses to reconsider how they manage payroll and search for tools that will help them minimize compliance risk, enhance productivity, and, ultimately, gain a competitive edge in an increasingly competitive global market.