Uganda is a landlocked country in East Africa. One of its best known geographical areas is Lake Victoria. Uganda offers visitors the chance to see a broad range of wildlife, including many rare birds. The biggest attraction for tourists just might be the Bwindi Impenetrable National Park, a renowned sanctuary for mountain gorillas and a World Heritage Site.

Brief Review of Uganda’s Journey

Uganda gained independence from Britain in 1962. The country then endured a military coup followed by a brutal military dictatorship under Idi Amin. Under his reign, hundreds of thousands died, and in 1972 thousands of Ugandan Asians were expelled from Uganda. In 1978-1979, Uganda invaded Tanzania. Tanzania retaliated and forced Idi Amin to flee Uganda. Uganda then faced a further military coup before President Yoweri Museveni came to power in 1985, which began an era of political stability and improved human rights.

In 2009, a United Kingdom oil exploration company announced a major oil find in Uganda. In 2011, the United States deployed special forces to help Uganda combat renewed attacks by Lord’s Resistance Army (LRA) rebels. Then in 2012, tens of thousands of refugees, fleeing fighting in the Democratic Republic of Congo, crossed the borders into Uganda.

In 2014, a tough new anti-gay bill became law, which resulted in the World Bank postponing a £54 million loan to Uganda. The United States followed by imposing sanctions.

All of these events have obviously led to increased pressure on the national budget. Against this background of continued challenges facing Uganda, celebrations in September 2016 honoured 25 years of “nation building” undertaken by the Uganda Revenue Authorities (URA). It was considered worthy of celebration, considering that as far back as 2010, Uganda was able to finance 70% of the country’s budget from revenue collections.

These celebrations were followed by news that the country will build its first ever gold refinery by the end of 2016.

Legal System

Uganda’s legal system is based on English common law and African customary law. Customary law is effective only when it does not conflict with statutory law. The laws applicable in Uganda are statutory law, common law, and doctrines of equity and customary law. (These laws are stipulated by the Judicature Act.)

Setting Up Business Bank Accounts

Opening a business bank account in Uganda requires the following documents and the completion of relevant application forms from the bank:

- Certified copy of the charter, statutes, or memorandum and articles of the company or other instrument proving the constitution of the company. If this document is not written in English, then a certified translation is required to accompany the original document.

- Certified list of the directors and secretary of the company and their due diligence paperwork.

- The names and postal addresses of one or more persons resident in Uganda who are authorized to accept notices on behalf of the company.

- The full address of the registered or principal office of the company.

There is a high probability the client will be obliged to meet the bank directors in order to open the account.

Employment Legislation

The Employment Act of 2006 is the main piece of legislation covering employment in Uganda. Nine further sources of legislation, rules, and regulations also need to be consulted to ensure compliance in Uganda:

- The National Social Security Fund Act

- The National Social Security Fund Rules S - I 222—1

- The Employment and Labour Relations Act, 2004

- The Employment Regulations, 2011

- The Labour Disputes Arbitration and Settlement Act, 2003

- The Workers Compensation Act, Cap 225, laws of Uganda 2000

- The Occupational Safety and Health Act, 2006

- The Labour Unions Act, 2006

- The Capital Markets Authority (Accounting and Financial) (Amendment) Regulation, 2006

Employment Contract

The contract of employment may be oral or written (Section 25 Employment Act of 2006). Contracts with employees who are illiterate must be attested with an attestation drawn up by a magistrate or a labour officer (Section 26 Employment Act 2006). (The Illiterates Protection Act also applies).

An interesting section of the Employment Act of 2006 deals with the scenario where the employer is not incorporated or resident in Uganda. In this instance, the employer needs to lodge a bond with the labour officer equivalent to one month’s wages for each employee employed. The bond is held in a separate interest-bearing account and is utilized if the employer defaults on payments to employees.

Minimum Wage

Only one minimum wage of 6,000 Ugandan shillings per month exists at the national level. As the rate has not been revised since 1984, it no longer makes economic sense. Reports suggest a new rate is due to be published soon, but as yet this has not materialised.

Working Hours, Overtime

Employees may not be required to work more than six consecutive days without a day’s rest. The maximum number of hours permitted per week is 48. (Employees may not exceed 10 hours per day or 56 hours per week. Shift workers are allowed to exceed this provided the average over a three-week period meets these requirements.)

Leave Entitlements

Maternity Leave—Female employees are entitled to 60 working days’ leave on full wages. At least four weeks must follow childbirth or miscarriage.

Paternity Leave—A male employee is entitled to four working days following the birth of his child or in the event of his wife’s miscarriage.

Annual Leave—Employees are entitled to seven days’ leave for every four continuous months completed service in a calendar year. Employees are also entitled to all public holidays.

Sick Leave—Any employee who has completed at least one month of employment will be entitled to one month of sick leave at full pay. After the employee’s second month of illness, the employer has the right to terminate the contract of employment provided all the conditions are met as contained in the employment contract.

Termination Notice

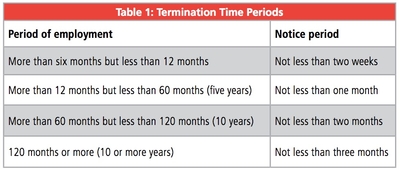

Notice needs to be given in writing and must comply with the time periods in Table 1.

Where the pay period for the employee is greater than the periods referred to in Table 1, the employee is entitled to receive notice of the equivalent time period.

Income Tax—Registrations and Filings

Ugandan tax residents are subject to income tax on their worldwide income, whereas non-residents are subject to tax on income accrued in or derived from Uganda.

Tax is imposed at graduated rates ranging from 0% to 40%. Employees are taxed on a monthly basis in terms of the Pay-As-You-Earn system. Tax is withheld at source by an employer on taxable amounts paid to an employee.

Employees who only earn employment income from a single employer do not have to submit annual income tax returns.

Employment income includes the value of any benefits in kind either provided by the employer or paid on behalf of the employee, termination benefits or payments, private or personal expenditures reimbursed by the employer, wages, salaries, leave pay, payment in lieu of leave, overtime, commission, gratuities, bonus payments, any form of allowance, and any discount or profit-/loss-on-share transactions.

The rates of tax payable by resident employees are listed in Table 2.

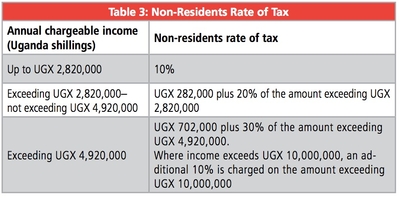

An individual will be deemed to be a non-resident employee if he or she does not meet the criteria set out for residency. Non-residents forfeit the benefit of the tax-free exemption as seen in Table 3.

The employer has a responsibility to withhold the correct PAYE (pay-as-you-earn)and make payment to the URA within 15 days after the end of the month in which PAYE was deducted. The employer is also required to submit a return by the same date. The return can be submitted using the URA e-filing system (Electronic submission for PAYE).

Local Service Tax (LST)

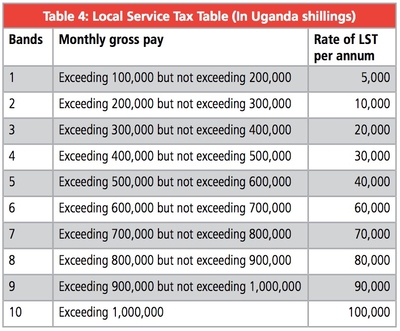

The Local Service Tax (LST) is levied on the earnings of employees under the Local Governments Act. LST is deducted from the gross earnings of the employee when calculating taxable income. LST is levied on the gross earnings as seen in Table 4 and is payable in the first four months of the Government’s financial year, July to October.

The employer needs to calculate and deduct LST and remit this to the place where the employee normally resides. Payment needs to be made by the 15th of the following month.

National Social Security Fund

Employers are obliged to contribute on a monthly basis to the National Social Security Fund (NSSF) 15% of an employee’s monthly salary, wages, and cash allowances; however, 5% may be deducted from the employee’s wage as his share of the contribution. This has the effect of reducing the employer liability to 10% and is therefore the practice followed by the majority of employers in Uganda. (From age 55 there is an exemption in place with respect to NSSF liabilities.)

Non-resident employees working in Uganda for more than three years are required to make contributions toward NSSF as well. If expatriate employees are still making payments toward a social security scheme in their home countries, they can apply to the fund for exemption from making contributions. The employer is still required to make a 10% contribution toward the fund. This 10% is not refundable when the employee leaves Uganda.

Uganda NSSF recently confirmed that online electronic filing is now available. The employer is required to visit the local NSSF office that will handle the monthly payments, where the office will create an online account for the client. Once the account is created, filing can take place electronically. The current procedure is to complete a template with the monthly NSSF contributions and to submit the schedule along with proof of payment to the assigned NSSF contact person via email.

Exchange Control

Uganda does not have exchange control regulations in place, but foreign currency transactions are required to be conducted through a local bank.

For a country that has been through turbulent periods in its history, the advancements made by the URA and NSSF are indicators that Uganda is keen to ensure that compliance is supported by an infrastructure that facilitates electronic filing and is relatively easy to use. These initiatives have also helped global payroll teams gain better control of payroll compliance in the region.