Solid global employment numbers of multinational companies (MNCs) are hard to find.

Solid global employment numbers of multinational companies (MNCs) are hard to find.

But according to Eurostat, there are 135,000 MNCs operating in European countries alone, and one in five people are employed in a multinational enterprise. Together, they employ no less than 42 million people across Europe.

It is no wonder that the demand for international payroll managers or specialist roles are increasing. And, that payroll professionals’ interest in a career in international payroll is growing.

Since roles for international payroll professionals are becoming more prevalent, Google’s search numbers for usable information about the multi-country payroll outsourcing (MCPO) industry are increasing. But nobody ever recovered from a disease by consulting “Dr. Google.” Hence, you may want to reconsider your approach if that’s what you’ve been doing thus far.

While expensive reports on the subject are omnipresent, it’s not easy for payroll professionals to find unlocked information about international payroll outsourcing. What follows sheds some light on the many MCPO-providers and on the possible collaboration models out there.

Two Types of Multi-Country Payroll Providers

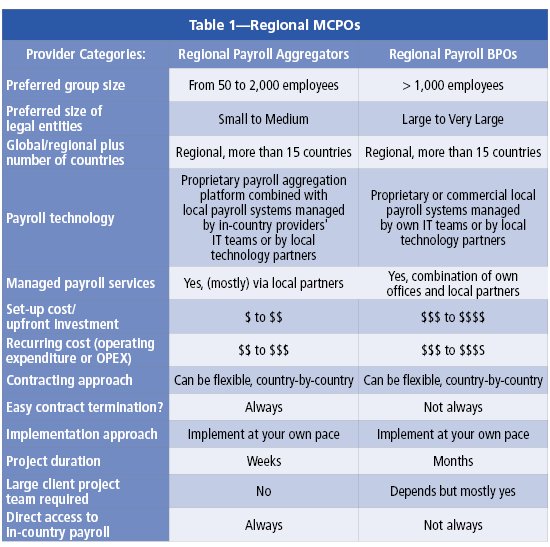

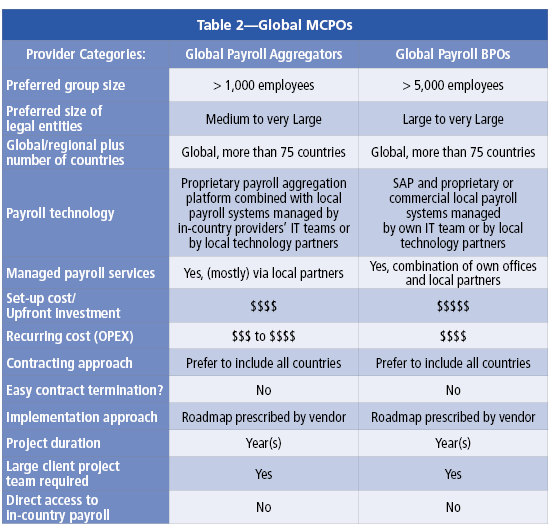

First, it is important to understand the distinctions between the two types of multi-country payroll providers, and the role each play in multinational organizations. The characteristics of these providers are listed in the following:

- The Aggregators

- Offer managed payroll services including direct operational payroll support (in your own language and time zone) generally through their network of in-country payroll providers (ICPs), but sometimes also with their own branches in countries with higher employee volumes

- Develop robust multi-country payroll platforms that allow for seamless integration with the ICPs’ payroll engines in view of multi-country unified input management and consolidated output reporting

- Leverage the local payroll systems from their partner ICPs to perform the gross-to-net calculation and to fulfil the local statutory and regulatory filings

- Either solely manage the commercial relationship with the customer or jointly with the partner ICP. If the latter is the case (i.e., a tripartite payroll service agreement with customer, aggregator, and partner ICP), then the customer is allowed to directly sign up for ancillary services with the partner ICP without prior approval of the aggregator.

- Appoint a single-point-of-contact for account management and dispute resolution between the parties

- The Business Process Outsourcing (BPO) Providers

- Offer managed payroll services in a tiered service delivery model for operational support, including:

- Customer is supposed to maximize the use of their automated payroll and knowledge tools to manage the end-to-end payroll cycle and to find answers on payroll matters (Tier 0)

- Customer can, only if they can’t find the answer themselves in the knowledge tool, contact service agents of their global or regional shared service centre (SSC) located in off-shore- or near-shore-countries, but only in a limited number of languages (Tier 1)

- Only their service agents in the SSCs (i.e., not the customer) can contact the in-country payroll experts that either are their own staff or, for countries with smaller employee volumes, staff of the partner ICPs (Tier 2)

- Either leverage the HR solutions of a systems, applications, and processes (SAP) software program to build a semi-proprietary international payroll system or develop proprietary multi-country payroll systems in-house

- Solely manage the commercial relationship. They are the main contractors and will only subcontract with partner ICPs in countries where they don’t have branches/capabilities. Partner ICPs are not allowed to agree to ancillary services directly with the customer without prior approval of the BPO.

- Appoint a customer success manager and service delivery managers (not for free) to the implementation project and the payroll operations

Simplifying MCPOs

Below are two simplified tables that not only briefly outline the needs of regional and global MCPOs but can hopefully streamline the selection of the correct solution for your organizational needs:

Hopefully you’re not wondering how you’re supposed to know which provider category best suits your international payroll needs. However, if this is the case, here are two examples that may be helpful:

- Global Multi-National Companies (GMNC)—As a GMNC, you probably are a long-established company with a presence in most of the world’s countries. You’ve probably already done a large implementation project of an enterprise resource planning (ERP) system on a global scale, and you prefer to acquire systems and outsourced services that help you to streamline your processes globally.

As any GMNC, you probably have a very small to a very large employee population in various countries. In that case, the BPO providers are your best choice for countries where you have more than 500 employees on the payroll. You can consider risking it all by including all your countries in the scope of a global payroll outsourcing agreement but beware that the total cost of ownership for the countries below 500 employees may become unpalatable.

It would be better to take a multi-provider approach, in which you optimally benefit from the strengths of each provider to still reach the desired full global payroll coverage.

Suppose that you’re a GMNC with 75,000 employees. You have 30,000 employees in four Asia-Pacific (APAC) countries, 15,000 in four Europe, Middle East, and Africa (EMEA) countries, 10,000 in the United States, and 5,000 in Brazil. The other 10,000 employees are spread worldwide over 50 countries (i.e., on average you have 200 employees on those payrolls).

This looks like a perfect case for spreading the lock-in, timing, and cost risks over multiple providers:

- A global aggregator or BPO for the 10 large countries with a total of 60,000 employees

- Four regional aggregators and/or BPOs (one per region) for the 50 small/medium countries with a total of 10,000 employees

- International Small and Medium-Sized Enterprises—You are a fast-growing company, quickly expanding into new markets. You’ve launched initiatives on several fronts to uplift process excellence and to install better governance. The domestic character of payroll and HR administration is giving you headaches, and you don’t have decent oversight on your workforce and labour costs. It’s time for centralization, unification, and optimization.

You’re headquartered in Europe, and your first international steps have been in the European region where you’re now present in 10 European countries, with plans to expand to five more countries. And launching your business in the United States is also on the radar.

You want to see fast results, not spend too much capital, and get a solid return on investment.

It looks like you’ll need a partner who understands and supports your optimization goals and who is ready to implement at your pace, at a reasonable cost.

Suppose that in your 10 European countries you employ 750 people, of which 300 are in the European headquarters with 450 spread over the other nine European countries (i.e., on average, you have 50 employees on those payrolls).

This is the perfect case for a European payroll aggregator. Once you are ready to launch in the United States, you can use a local HR/payroll provider to assist you with the legal side of setting up as an employer.

Things to Know Before Choosing an MCPO

While transforming towards an international target operating model for your payroll operations comes with obvious and proven benefits, it is still advisable to check the critical elements before outsourcing to a payroll aggregator or BPO provider.

Make sure to probe these elements before selecting your MCPO provider:

- Is the international payroll system unified and integrated for all my in-scope countries?

- Are both the front-end and the back-end systems supporting straight-through, touchless payroll processing, including those of the partner ICPs?

- Can we easily integrate their international payroll system with our HCM, time and attendance, and other systems?

- Do all their implementation project team members have sufficient payroll and IT expertise?

- Who can we contact if we have questions; do we get to speak directly with (local) payroll experts?

- Will we sign a single version of the contract for all the countries in-scope, with harmonized pricing for subregions, or will each country have a different contract version and pricing?

- What kind of due diligence has the provider done before allowing the partner ICPs in its network; can we review the process and/or questionnaire?

- For how long is the contract and can it be terminated quickly and without penalties if needed?

If you’ve decided to organize your payroll function internationally, then you should be aware of a few more things.

- You will spend quite a bit of time designing the right target operating model and selecting the right provider who can co-execute on your international payroll strategy

- You’ll need to replace all your incumbent payroll providers and payroll systems (no matter which category of provider you choose)

- You will have to include some of your payroll professionals in the implementation project team

- You’ll be required to foresee time and budget for proper change management

Don’t be discouraged. Most providers are ready to share the workload with you and can also advise you on the right approach as they’ve guided many organizations before.

International payroll outsourcing has long come of age and has now become a mature industry. But let’s not be shy about it; there have been quite a few failed projects in the early days. With a lot of new, well-funded players entering this market, the established providers are getting challenged and pushed out of their comfort zones, which is always a good sign for an industry.

There are plenty of good MCPO providers to choose from today. Their offerings are rich, and the products and services have stabilized over the years. Yet, there are also still some distinctions between the different categories of providers. Hence, candidates for international payroll outsourcing should thread with care. Shouting “Big bang!” “One throat to choke!” or “Not more than one MCPO for our international payroll!” is a thing of the past.

So, make haste, but do it slowly. International payroll outsourcing is a marathon, not a sprint. And for a marathon, you want to travel light.