Managing global payroll—always a complex task—became even more challenging in 2022. In fact, global payroll was especially demanding for mobile employees, and there were two significant reasons that helped create this complexity.

Tackling Global Mobility Challenges

In 2022, global businesses that were still slowly emerging from the COVID-19 pandemic, and searching for a sense of normalcy, quickly realized that the demands of global payroll were significantly impacted by the following:

- Expatriate Assignments: The first involved a significant decline in traditional expatriate assignments. This, of course, spurred the growth of project work, short-term assignments, and international remote working. The pandemic radically accelerated this shift, meaning that payroll professionals now must manage far more payroll scenarios.

- Employee Expectations: Simultaneously, businesses must contend with increasing employee expectations regarding their experience at work, whether home or abroad. Employees now expect slick, digital experiences in every aspect of their working lives. This expectation extends to pay where receipt of an accurate, digital record of pay, including tax and social security liabilities, is vital.

These complications create overwhelmingly stressful situations for payroll professionals who deal with globally mobile employees continually. This stress is a result of their workload and the types of tasks that they’re asked to complete. Many of these are repetitive and require a deep level of expertise—such as shadow payroll. There are several technology solutions on the market that will automate many payroll-related tasks and help streamline payroll operations. However, too often, this brings up a second problem: Which technology to choose.

Finding the Right Technology Integration

Payroll professionals know that the right technology could make their lives easier, but many organizations are cautious about making technology, people, and time investments. How do they get this right without a high risk of effort and cost?

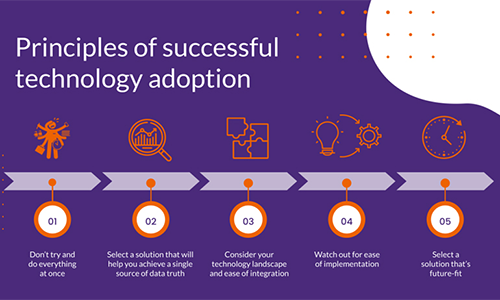

Before taking this route, the payroll professional or team should carefully identify what the business needs from them, what they are struggling to deliver, and how technology can solve these problems. With this insight front-of-mind, professionals can then go about selecting and integrating the technology that will help them address their pain points. For this, there are five principles for success as seen in the image.

-

Don’t Do Everything at Once

During the assessment phase, professionals often identify several areas where technology could be applied. Many will often create a long wish list and try to get investments approved all at once. While this may seem sensible, a far better approach is to address one or two problems at a time.

This approach helps to avoid many of the concerns businesses often have with bringing new technology into their stacks, as it cuts down on introducing overcomplicated “one-stop-shop” solutions and gives teams the opportunity to use new tools without becoming overburdening.

Thus, teams can experience how technology can improve the process of managing the complex task of payroll for their expatriate workforce and how employees will experience it for themselves. It can also enable business leaders to directly measure the immediate improvements that technology brings to the payroll function and allows for future investments for the next steps.

-

Find a Solution That Gives You a Single Source of Data Truth

Payroll teams can be extremely valuable to a business if have access to up-to-date and accurate real-time information, with respect to compensation and benefits of their expatriate workforces. Thus, having siloed data sitting in different systems makes this much harder. This can mean that relatively simple questions, such as the size or cost of an expatriate workforce, can be a struggle for payroll teams to answer.

To save time and erase inaccuracies, businesses should aim to use technology tools that give them a single source of truth (SSOT). This allows teams to focus on decision-making informed by data. From a practical perspective, this means using a platform that enables data migration into one unified hub.

-

Consider Your Technology Landscape

If businesses want to enjoy the benefits of integration and have one platform to pull data from multiple sources, they must consider their technology landscape. This requires professionals to carefully consider the systems that the new tools will need to connect with to ensure integration can be achieved. Much of the expatriate data is crucial for other areas of the business, such as global mobility, HR, corporate tax, transfer pricing, and in some cases, client invoicing. A crucial aspect of this is to look beyond payroll systems and consider how the solution integrates with other departments’ systems to provide business continuity across functions.

The best way to ensure compatibility is to use a cloud-based solution with API (Application Programming Interface) capabilities. This ensures the solution can plug into existing systems securely and is unlikely to disrupt operations in any way.

-

Watch Out for Ease of Implementation

There is nothing that can diminish the glow of new technology than a long implementation process. Months-long implementations used to be the norm, which posed a significant barrier to the success of busy payroll teams.

Now, implementing new tools can be done in far less time. It is important to find solutions—and vendors—that can provide a clear and well-planned implementation roadmap. This will ensure the timeliness of any technology integrations, which can be make-or-break for maintaining support from the wider business.

-

Select a Solution That’s Future-Fit

If the last few years have taught us anything, it’s that nothing is certain. It is challenging to predict future needs and trends. This is important when businesses consider their technology solutions because they must aim for flexibility and adaptability to avoid tethering themselves to one way of operating indefinitely.

No one needs a degree in technology to purchase or successfully implement technology. You just need to be able to pinpoint what you need, the characteristics of the solution, and what the result should look like. The most important part of any technology integration is that the business and teams involved know exactly what they want to achieve.

The Benefits

When it is done correctly, the benefits of technology integration are huge. Businesses will benefit from a more strategic payroll function, able to spend much of their time thinking about what the business needs and delivering on this. Payroll teams can furnish business leaders in various departments with accurate data, which will help them make more informed decisions about their workforce and business decisions.

Expatriate employees will also benefit if businesses can use technology to handle complex and repetitive tasks. Think how much more time can be spent creating better and more tailored experiences for expatriate employees, all while making sure assignees are paid on time with no issues from the home or host tax authorities.

This brings us to the final piece of the puzzle: the benefits to payroll professionals managing a globally mobile workforce. These are tenfold and come down to this: Through successfully integrating the right technology, you can free yourself of repetitive manual tasks to spend time on tasks that you enjoy and make you feel like you’re adding value to the business.

You’ll radically reduce your workload pressures and be able to go home and spend time with the people or pets, who, let’s face it, are probably far more important to you than work.