Digital assets—aka cryptocurrencies—are an alternative form of value to traditional fiat currency that may be used to pay foreign suppliers in the not-too-distant future. The speculative frenzy in 2017 which drove cryptocurrency values to ridiculous and unsustainable levels only to collapse 85% in 2018, has brought a skeptical awareness to the emerging world of digital assets. The anonymity and peer-to-peer (P2P) nature of bitcoin, the first cryptocurrency, enabled early adopters to easily use it for a wide range of illicit activity.

Digital assets—aka cryptocurrencies—are an alternative form of value to traditional fiat currency that may be used to pay foreign suppliers in the not-too-distant future. The speculative frenzy in 2017 which drove cryptocurrency values to ridiculous and unsustainable levels only to collapse 85% in 2018, has brought a skeptical awareness to the emerging world of digital assets. The anonymity and peer-to-peer (P2P) nature of bitcoin, the first cryptocurrency, enabled early adopters to easily use it for a wide range of illicit activity.

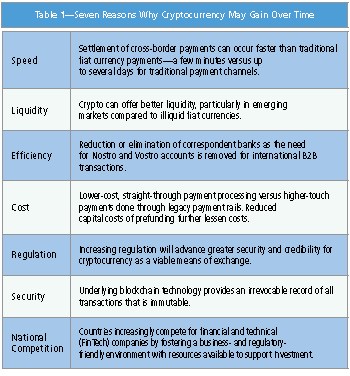

That said, over time as the global economy continues along a steady path of digital transformation, a more mature digital asset may become a means of value exchange between two parties in some international transactions. Crypto may work particularly well in cases where foreign markets have various restrictions or practices that inhibit efficient and cost-effective flow of that country’s fiat currency in a cross-border context. There are several reasons why cryptocurrency and the underlying blockchain technology may gain traction over time (see Table 1).

That said, over time as the global economy continues along a steady path of digital transformation, a more mature digital asset may become a means of value exchange between two parties in some international transactions. Crypto may work particularly well in cases where foreign markets have various restrictions or practices that inhibit efficient and cost-effective flow of that country’s fiat currency in a cross-border context. There are several reasons why cryptocurrency and the underlying blockchain technology may gain traction over time (see Table 1).

Despite extensive publicity surrounding digital assets, it is still too early to gauge if or how the payment industry will embrace this new form of value. Many feel that cryptocurrency and the underlying blockchain or distributed ledger technology represent a solution in search of a problem. Skeptics think more cynically that cryptocurrency is actually the proverbial emperor with no clothes. Regardless of one’s view, it is safe to say we are at an inconclusive and early stage for both cryptocurrency and the underlying blockchain technology. There are many private blockchains attempting to address various business challenges, including payments. The significant scalability challenge with private blockchains for cross-border payments is the need for large amounts of liquidity which, by definition, as private, they lack. The largest public blockchain supports bitcoin, which has enough negative history that future success remains debatable. Examples of large payment systems today include FedWire, ACH, NY CHIPs, and the U.K.’s CHAP system, to name a few. All of these systems share similar characteristics:

- Large payment volumes

- Security

- Known costs

- Deep liquidity pools

- Established operating rules

By contrast, crypto still resembles a Wild West market. However, progressive central banks and regulators in markets such as the Philippines, Thailand, and Japan are putting more structure in place for not only how crypto is regulated, but also how it can be used.

How Crypto Payments Work Today

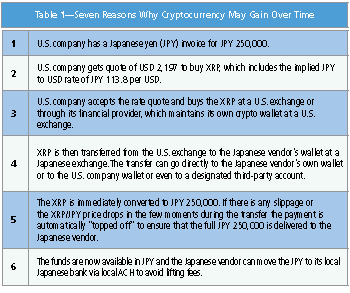

So how does a crypto payment work today? Let’s say a U.S.-based company wants to pay a vendor in Japan. Today that Japanese yen payment will take up to three business days to deliver and be subject to heavy lifting fees (the receiving bank practice of deducting fees from the payment’s principal). These lifting fees are not transparent to the U.S. sender. Cryptocurrencies can be used as a bridge currency between the United States and Japan with minimal to no exposure to exchange rate volatility or to lifting fees. The scenario mentioned above, and shown in Table 2, showcases the crypto benefits of speed and settlement while eliminating the major negative element, volatility. This crypto scenario uses XRP, just one of many cryptocurrencies.

So how does a crypto payment work today? Let’s say a U.S.-based company wants to pay a vendor in Japan. Today that Japanese yen payment will take up to three business days to deliver and be subject to heavy lifting fees (the receiving bank practice of deducting fees from the payment’s principal). These lifting fees are not transparent to the U.S. sender. Cryptocurrencies can be used as a bridge currency between the United States and Japan with minimal to no exposure to exchange rate volatility or to lifting fees. The scenario mentioned above, and shown in Table 2, showcases the crypto benefits of speed and settlement while eliminating the major negative element, volatility. This crypto scenario uses XRP, just one of many cryptocurrencies.

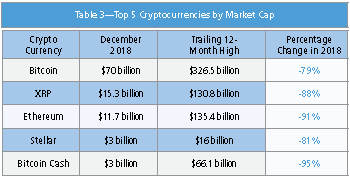

Cryptocurrency exchanges are still in their infancy, so costs, security, and quality vary widely (see Table 3). But 2019 should demonstrate improvements in all areas. Eventually, crypto exchange costs may equal and ultimately be lower than traditional fiat currency payment rails.

Quick delivery of this payment into Japan is an extremely attractive feature. The XRP moves almost real-time compared to up to three days in the current payment environment. Additionally, this manner of payment eliminates lifting fees as no bank is involved in the cross-border aspect of the payment. And finally, with a “top-off” feature, the receiver is guaranteed to have the full amount of Japanese yen (JPY) credited to its wallet and avoid any currency volatility.

Quick delivery of this payment into Japan is an extremely attractive feature. The XRP moves almost real-time compared to up to three days in the current payment environment. Additionally, this manner of payment eliminates lifting fees as no bank is involved in the cross-border aspect of the payment. And finally, with a “top-off” feature, the receiver is guaranteed to have the full amount of Japanese yen (JPY) credited to its wallet and avoid any currency volatility.

One might argue that there is foreign exchange risk between the cryptocurrency and the conversion into Japanese yen; however, the ecosystem of software and service providers being built around cryptocurrencies are prototyping solutions to guarantee rate parity. This structure will protect the beneficiary from exposure to any volatility when moving the U.S. dollar (USD) to crypto and then converting to another fiat currency such as JPY. Risk-prevention improvements like this foster greater confidence in the digital asset and should help promote increased adoption.

Embrace Faster Payment Process

Clearly cryptocurrencies and the underlying blockchain represent challenger business models to fiat currencies and the payment rails that support them. Blockchain technology has already forced legacy providers to improve payment speed. The biggest example of this is SWIFT’s recent Global Payment Innovation (GPI) Initiative, which involves the use of a new transaction reference that is fully transparent throughout the payment process. The result of GPI is that cross-border payments are moving faster simply because of payment visibility. SWIFT, however, is not introducing a new way to make payments. Rather, it’s focused on incremental improvements to the existing payment rails. Challenger models involving cryptocurrency introduce a whole new way of moving value. Banks that have invested billions in their cross-border payment infrastructure—including SWIFT connectivity—are inclined to protect the status quo versus introducing wholesale change, resulting in a clash of views on which direction cross-border payment flows may develop. While the digital asset and blockchain innovators are looking to disrupt, banks are understandably more geared to incremental change and to protecting their large investments in legacy payment technologies.

The continued growth, evolution, and adoption of cryptocurrencies and blockchain technology should stay on organizations’ fiscal radar so they can assess and take advantage of any potential benefits where and when they arise.

Andrew Woelflein is the Chief Strategy Officer at Tempus, www.tempusfx.com, a provider of corporate foreign exchange and international payment services, based in Washington, D.C.