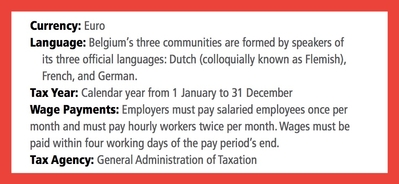

The Kingdom of Belgium—located in Western Europe—is a parliamentary democracy and a member country of the European Union. Belgium is composed of three regions—Flanders, Wallonia, and Brussels. Both Flanders and Wallonia are subdivided into five provinces each.

The Kingdom of Belgium—located in Western Europe—is a parliamentary democracy and a member country of the European Union. Belgium is composed of three regions—Flanders, Wallonia, and Brussels. Both Flanders and Wallonia are subdivided into five provinces each.

Brussels is the headquarters of the European Union and the North Atlantic Treaty Organization (NATO), making it home to a multitude of international diplomats and civil servants at any point in time.

Labor Standard Act or Employment Act

Several types of employment contracts (Contrat de travail/

Arbeidsovereenkomst) commonly are used in Belgium. Manual workers and white-collar workers have different contracts. In addition, separate contracts exist for domestic workers, student workers, professional athletes, and home workers. Contracts vary in length and complexity.

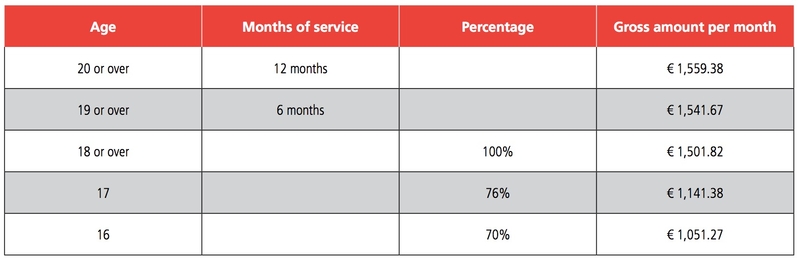

Minimum Wage

Not every employer is obliged to pay a monthly minimum wage. Most collective agreements (CAOs) include a provision on a “guaranteed average monthly minimum wage.” The minimum wage an employee is entitled to depends on age and the number of months the employee has worked for the employer (see Chart 1).

Working Hours and Overtime Pay

In Belgium, working hours must not exceed eight per day or 38 per week. It is forbidden in principle to work more than the legal working hours, outside the applicable schedules, on Sundays, bank holidays, and at night. In most cases where working beyond the statutory working hours is authorized, either in the context of regular work regimes or in the context of overtime, compensatory rest times are compulsory. They must be granted in such a way that normal weekly working hours are respected on average during a reference period.

Overtime is paid at 50% above the normal rate, or 100% in the case of work on Sundays or public holidays. Night work is forbidden between 8 p.m. and 6 a.m.; however, exemptions may be obtained. Night work is authorized provided the nature of the work or activity justifies it. For instance, night work is permitted in hotels, entertainment, health care, and agricultural work.

Employment Contracts

- Permanent contracts/Open-ended contracts (Contrat de travail pour une durée indéterminée/De arbeidsovereenkomst voor onbepaalde tijd): Contracts that are for an indefinite length of time.

- Fixed-term contracts (Contrat de travail pour une durée déterminée/De arbeidsovereenkomst voor bepaalde tijd): Contracts that specify a start and an end date for the employment.

- Specific-assignment contracts (Contrat de travail pour un travail nettement défini/De arbeidsovereenkomst voor een duidelijk omschreven werk): Contracts that come to an end when the relevant work has been completed.

- Replacement contracts (Contrat de remplacement/De vervangingsovereenkomst): Contracts that are for an employee to replace an existing employee who is absent for a reason, such as maternity leave, etc. The contract must detail the identity and the duties of the person replaced and the reason for and length of the contract. These may not exceed two years.

National Holidays for 2016

Employees are entitled to remuneration for 10 official public holidays (see Chart 2). If a public holiday falls on a Sunday or on a day the employee does not usually work, the employer must grant a replacement day.

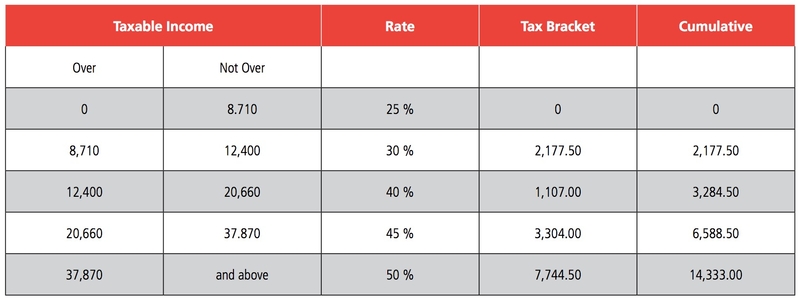

Income Taxes

The tax year runs from 1 January to 31 December. Employers deduct income tax (impôt des personnes physiques or personenbelasting) from employee salaries on a monthly basis, which is known as the Précompte Professionnel/Bedrijfsvoorheffing. Similarly, paid company directors and the self-employed have to pay monthly tax in advance via a collecting agency or bank. Regardless, all residents of Belgium and non-residents taxed on Belgian-sourced income have to file an annual Belgian tax return.

Employees usually receive a tax return in May or June (déclaration/aangifte) relating to the previous year’s income. This typically must be returned by the end of June, although employees will find the exact date on their tax returns.

Employees who use the “Tax-on-Web” online filing system traditionally are allowed some extra time. Non-residents file their returns at the end of September/beginning of October.

Employees who don’t submit their returns by the deadline may face a fine, and the tax authorities may estimate how much tax they need to pay. Employees can track the progress of their tax return through FPS. They are taxed on earned income minus mandatory social security contributions, personal allowances, dependent spouse allowance, and professional costs (as an actual amount or fixed standard cost). In addition to income earned through employment or self-employment, other taxable income includes income from real estate and investments (see Chart 3).

Payment due dates—Employers must transfer tax deductions (BV, “bedrijfsvoorheffing”) to the Administration of Direct Taxes by the 15th of the following month.

Social Insurance Programs

Social Insurance Programs

Reference earnings for social insurance programs discussed here are 100% of the insured’s gross earnings for white-collar workers and 108% of the insured’s gross earnings for blue-collar workers.

Old Age, Disability, and Survivors

Insured person—7.5% of reference earnings. Pensioners and pre-pensioners contribute from 0.5% to 2% of the pension or pre-pension. The pre-pension is paid under unemployment to insured persons aged 60 or older with at least 30 years (for men) or 26 years (for women) of employment. The insured’s contributions finance old-age and survivor pensions.

Self-employed person—not applicable

Employer—8.86% of reference earnings. The employer’s contributions finance old-age and survivor pensions.

Disability pensions and funeral grants are financed under Sickness and Maternity.

Sickness and Maternity

Insured person—3.55% of reference earnings (medical benefits) and 1.15% of reference earnings (cash benefits and disability pensions). Pensioners contribute 3.55% of the old-age or survivor pension (low-income pensioners are exempt from contributions).

Self-employed person—not applicable

Employer—3.8% of reference earnings (medical benefits), 2.2% of reference earnings (cash benefits and disability pensions), and 0.15% of reference earnings (maternity benefits).

Work Injury

Insured person—none

Self-employed person—not applicable

Employer—0.32% of reference earnings plus an insurance premium that varies according to the assessed degree of risk.

Occupational disease—1% of reference earnings plus 0.01% for asbestos-related illnesses.

Unemployment

Insured person—0.87% of reference earnings

Self-employed person—not applicable

Employer—1.46% of reference earnings. In certain cases, an additional 1.6% of reference earnings is paid by employers with more than 10 employees.

Family Allowances

Insured person—none

Self-employed person—not applicable

Employer—7% of reference earnings

Time Off

As of April 2012, employees who are starting their careers—or who are restarting their activities after a long time off—are entitled to additional vacation time after an introductory period of three months so that they have the possibility to benefit from four weeks of vacation over one year. The employee will receive vacation pay that is equal to his/her regular salary. Vacation pay will be financed through a deduction from the double holiday (vacation) pay of the next year. Employee leave is determined by the number of days actually worked, as well as the number of inactive days counted as fully worked days (such as sick leave), during the year directly preceding the current year. If workers were employed for five-day workweeks during the full preceding year, then employees are entitled to 20 days of vacation leave in the current year. If employed in six-day workweeks during the full preceding year, then they are entitled to 24 days of vacation.

Hourly worker vacation time is paid for by the holiday fund or the National Office for Annual Leave, which determines payments based on employee salaries from the previous year and is slightly more than 15% of employee salaries.

Employers directly pay employees for vacation time, including both the vacation pay owed and a supplement, which is equal to 1/12th of 92% of employees’ gross salaries.

An employee over the age of 50 who has not worked enough time during the previous year to claim a full four-week holiday is eligible for senior holiday pay at 65% of his or her salary, paid by unemployment insurance. Likewise, a worker under the age of 25 who has not accrued enough time on the job to qualify for a full four-week holiday may receive an allowance equal to 65% of his or her salary, paid by unemployment insurance.

Maternity/Paternity Leave

Women receive maternity benefits whilst on maternity leave. The benefit is equivalent to 82% of salary for the first 30 days and then drops to 75% of salary, subject to a maximum salary. Women may take up to 15 weeks’ maternity leave. At least nine weeks must be taken after the birth, and at least one week must be taken before the date when the baby is due.

After the birth of a child, the father has a right to 10 days’ paternity leave, seven of which will be paid for by the social security system at 82% of salary (subject to a maximum). This leave must be taken within four months.