Labor relations in Mexico are characterized by both strict regulations and practices as well as some flexibility. The labor market has been influenced by significant labor reforms that have led to segmentation of the labor market itself. From here on, we will analyze practical and relevant aspects in personnel administration and payroll in Mexico.

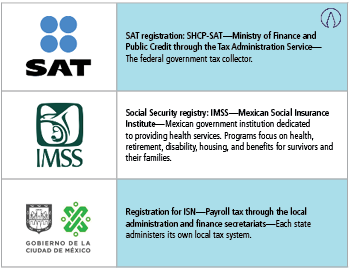

Mexico is made up of 32 federal states that are regulated by a uniform labor law: the Federal Labor Law. When a company decides to set up operations in Mexico, it will have to notify and register with the below-mentioned authorities:

A fourth register may also be required before the National Institute of Immigration (depending on the company and employee base).

Once a company is registered, it will be able to initiate recruiting and hiring employees according to the following procedure:

- Federal law states a labor contract must be signed between employee and employer, which outlines the salary, benefits, and other details of the employment relationship

- No special registration format is required; a file containing the personal, academic, fiscal, and social security information of the worker(s) is sufficient

- The employee(s) must be registered on the social security website(you can also register salary changes, new hires, and terminations)

- Employees may be hired under indefinite and fixed contracts

Benefits, Withholdings in Payroll Calculation

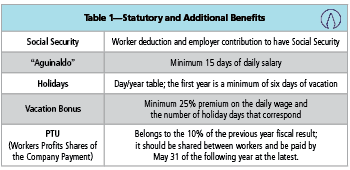

One of the main aspects that a company must consider when formalizing payroll in Mexico is the PTU payment, or Workers Profits Shares of the Company Payment. This type of disbursement requires a pre-cost analysis, as the law establishes that the income declared in the company’s corporate tax generates a tax benefit that must be distributed among the workers of the company.

Table 1 illustrates the statutory and other additional benefits according to Federal Labor Law.

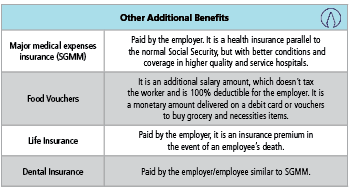

When calculating the withholdings to be applied to payroll, it is important to note the following:

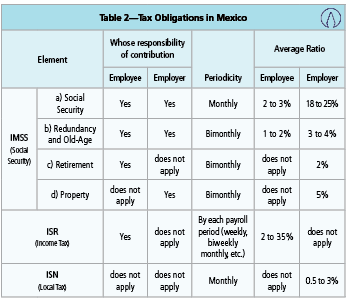

- IMSS: These are social security contributions withheld from the employee and paid by the employer.

- ISR: This is the tax withheld from the employee and paid by the employer that is calculated according to the taxable basis. It is a progressive tax that will depend on the salary that the employee receives.

ISN: Local taxes are strictly employer funded.

ISN: Local taxes are strictly employer funded.

Table 2 demonstrates the differences between the various contributions in Mexico.

The Payroll Pay Slip

Since 2012, it is obligatory to validate and certify payroll pay slips by the SAT. The Income Tax Act establishes the obligation of stamping all pay slips by a certified authorized provider and an SAT-Interface payroll software.

Stamping is mandatory for all information contacting personal compensation. Pay slips must be stamped and sent to the SAT. Companies are exempt from filing annual returns. This change was implemented at the start of 2018.

Stamping is mandatory for all information contacting personal compensation. Pay slips must be stamped and sent to the SAT. Companies are exempt from filing annual returns. This change was implemented at the start of 2018.

Employee Dismissal

Two different kinds of documents must be delivered to employees when they leave employment with the company: the settlement and the liquidation.

1. Settlement. These are the documents used in case of voluntary departures. They must cover the following elements:

- Pay according to the outstanding days of payment

- Bonuses proportional to the date of payment

- Other elements that the employee is entitled by law or contract

2. Liquidation. This is applied in the case of unilateral decision of the employer, without any reason attributable to the employee. The following elements must be covered:

- 90-day salary compensation

- 20 days per working year or proportional part

- Old premium

Do you like our content? Join the GPMI community to get free education and articles straight to your inbox!

Auxadi provides International expansion services under a single IT platform as One-Stop-Shop solution in accounting, tax compliance and payroll. From its HUBS in Chicago & Madrid, with over 40 years of experience, 250 employees, 10 intl offices, its Intl Desks and its cloud platform, Auxadi helps more than 1000 US & European corporations expanding abroad.